Retail Sales Decline for a Third Consecutive Month

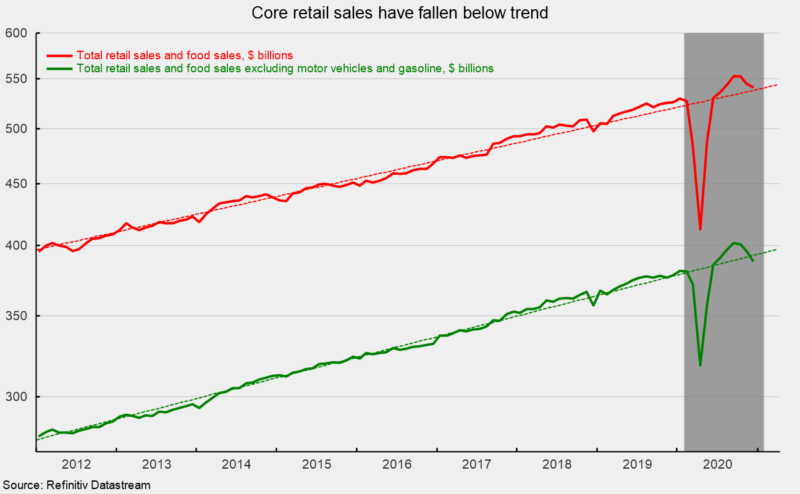

Retail sales and food-services spending posted a third consecutive decline in December, falling 0.7 percent from the prior month following a 1.4 percent drop in November and a 0.1 percent drop in October. The three consecutive decreases follow five consecutive gains for May through September and two devastating declines in March and April. The recent declines move retail sales back towards the nine-year trend (see first chart).

Core retail sales, which exclude motor vehicles and gasoline retailers, posted a sharp 2.1 percent drop for the month following decreases of 1.3 percent in November and 0.2 percent in October. Core retail sales are now below trend (see first chart).

The three-month annualized rates of change are -8.3 percent for total retail sales and food services, and -13.3 percent for core retail sales. For core retail sales, the three-month pace of decline is the second-worst on record (since 1992), trailing only the three months through April 2020. From a year ago, total retail sales are up 2.9 percent while core retail sales show a 2.6 percent rise. Both are towards the lower end of the typical growth rate range over the past decade. The current 12-month rates are well below the 10-year annualized rates of 4.3 percent and 4.1 percent, respectively, for the ten years through December 2019.

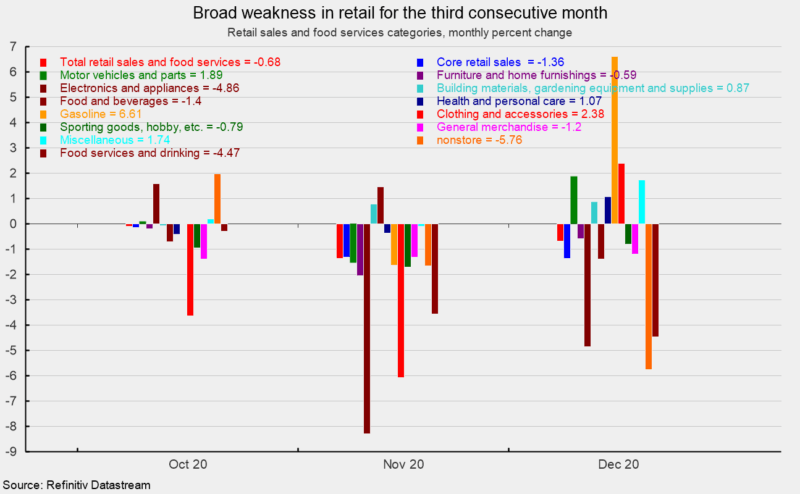

For a third consecutive month, results across the various categories of retailers were generally weaker. Seven of the thirteen major categories reported declines in December sales (see second chart). Decliners were led by nonstore retailers, primarily online shopping, with a 5.8 percent drop, followed by electronics and appliance stores (-4.9 percent), and restaurants (-4.0 percent). Gainers included a 6.6 percent rise for gasoline stations sales followed by clothing and accessories stores (2.4 percent), motor vehicles and parts sales (1.9 percent), and miscellaneous store sales (1.7 percent; see second chart).,

The December results leave five of the 13 categories with sales still below their pre-lockdown levels. Restaurants were 22 percent below January followed by electronics and appliances (17.5 percent below), clothing and accessory stores (15.5 percent below), gasoline stations (11.2 percent) and furniture and home furnishings retailers (0.3 percent below).

Retail sales fell for a third consecutive month in December as renewed quarantines and lockdowns hit economic activity. The economic recovery remains very fragile and highly dependent on the progression of Covid-19 and government policy responses. A full return to pre-pandemic conditions for the overall economy and the labor market is likely several months, and possibly a few quarters, away.

Recent Comments